Trade Tensions: US Liquor Sales in B.C. Drop 18%

British Columbians put their money where their mouths are when it comes to US Liquor purchases

Wholesale US liquor sales in BC drop 18% in the first 3 months of 2025 compared to same period in 2024

The tariff actions initiated by the U.S. against Canada, starting early in 2025, along with bizarre comments about annexation, led to removal of US products by Canadian liquor distributors and widely reported negative sentiment from Canadians toward purchasing US alcohol, among other US goods and services.

Now the data is in, for British Columbia at least, and it does appear that U.S. producers are seeing a noticeable decline in sales, according to the latest BC Liquor Distribution Board Liquor Market Review for quarter ended March 31, 2025. The trend can be seen in my BC Liquor Market Review dashboard - let’s take a closer look.

In short:

- $6.3M loss in overall net sales drop from $34.9M Jan-Feb-Mar 2024 to $28.5M during the same period in 2025

- 18.2% decline year-over-year for first quarter

- Red wine by far the largest contributor the decline, followed by white wine

- already a downward trend since 2022, but previous year-over-year decline for Jan-Feb-Mar was less than 10%, so current situation with tariffs and insults related to annexation can be assumed to be at least a major factor.

US Alcoholic Beverage Sales in BC

BC liquor sales are not cleanly broken out by country of origin for all categories, but we can get a sense by looking at some of the subcategories within broader categories:

- Beer: USA Beer

- Spirits: American Whiskey & Bourbon Whiskey

- Wine: USA Wine (with further breakout into red, white, rose, sparkling, fruit wine)

- Refreshment Beverages (Cider/Coolers): no geographic breakdown, but the smallest category at around 12% of total sales

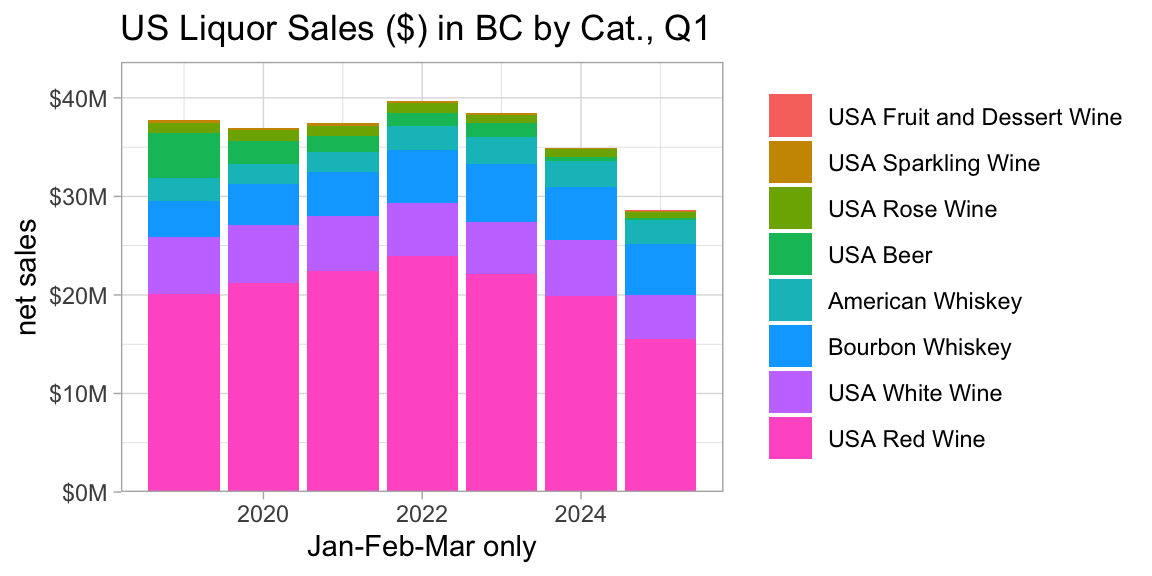

Since the data is available on a quarterly basis, we can compare sales in Jan-Feb-Mar for each of the last few years to see what the trends are.

Overall View

The drop in Net Sales $ in Jan-Mar 2025 (~$28M compared to ~$35M for 2024) is clear, although it is an acceleration of a trend that has been going on since 2022:

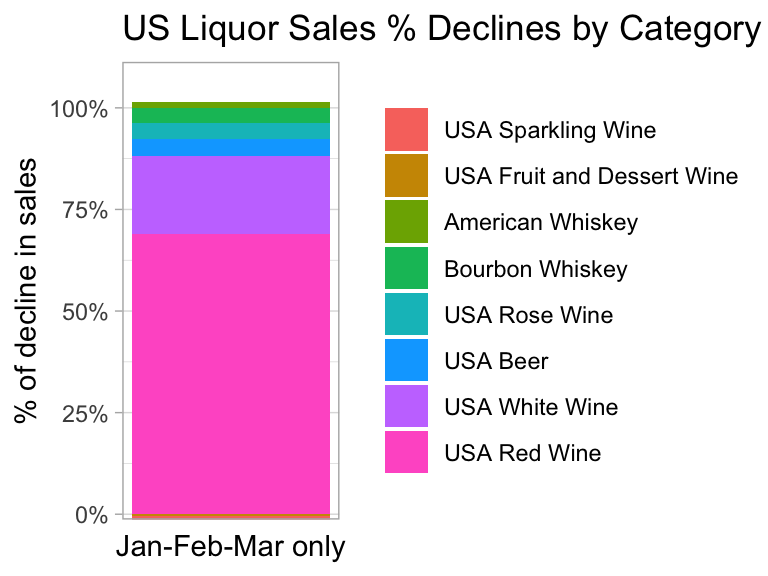

18% Drop Year-over-Year

On a % change basis, we can see how strongly the trend has accelerated:

- sales for Jan-Feb-Mar 2025 down 18% vs same period 2024.

How does this compare to overall sales as benchmark?

For comparison to overall change in sales for Jan-Feb-Mar each year (exclude refreshment beverages), we can go directly to the BC LMR dashboard on Fig4.com and apply some filters as shown:

- Overal liquor sales are down - but only around 1%, so the US decline is way beyond overall trend

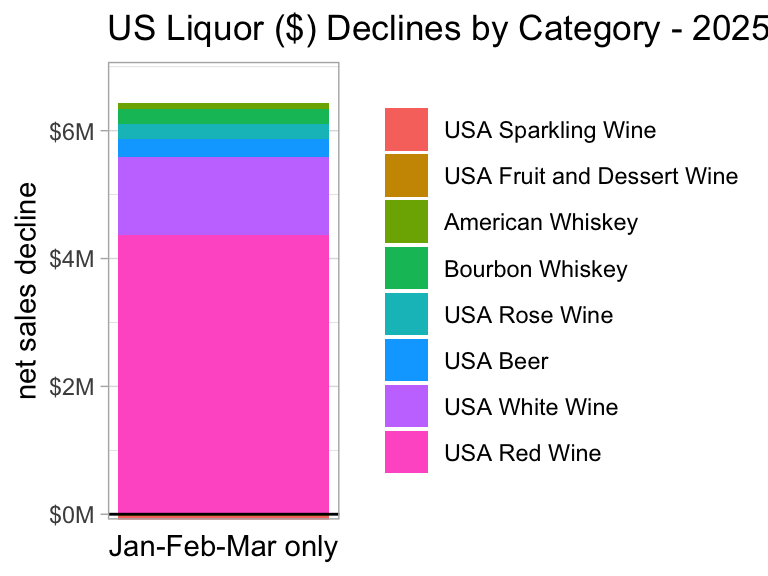

Category Impact

Drilling into the categories, we can see US red wine is the major driver at work here:

The overall $6.4M decrease breaks out by these categories, with Red Wine by far the leader:

- left chart: category contributions to total $ decline

- right chart: % of overall $ decline accounted for by different categories.

Conclusion

The first quarter of 2025 has seen a sudden and unprecedented drop in US liquor sales in British Columbia - almost 20%, accounting for over $6M dollars.

We will see how this trend evolves once the next quarterly report comes out in a month or so, but for now it appears that combination of tariffs and annexation talk has resulted in British Columbians following through on threats to steer away from US-produced alcoholic beverages.

- Notes

-

- all data sourced from British Columbia Liquor Distribution Branch Liquor Market Review reports (LMR).

- LMR report focuses on provincial sales through the wholesale channel. May exclude some other sales channels, but believed to be highly representative, due to how liquor distribution is managed in British Columbia.

- sales are reported in ‘net dollar value’, based on price paid by the (wholesale) customer, excluding taxes.

- see the link above for more details.